Planning a trip? Whether it’s a domestic getaway or an international adventure, understanding travel insurance is crucial for protecting yourself from unforeseen circumstances. From trip cancellations and medical emergencies to lost luggage and flight delays, travel insurance can provide financial protection and peace of mind. This article will delve into the essentials of travel insurance, helping you understand what it covers, the different types available, and how to choose the right policy for your needs. Navigating the world of travel insurance can be daunting, but understanding the key components can empower you to make informed decisions and travel with confidence.

Explore the intricacies of travel insurance coverage, including emergency medical expenses, trip interruption, and baggage loss. We’ll discuss factors to consider when selecting a policy, such as pre-existing conditions, adventure activities, and destination-specific risks. By gaining a comprehensive understanding of travel insurance, you can safeguard your investment and ensure a smoother, more secure travel experience. Learn how to evaluate policy benefits, coverage limits, and premium costs to make the best choice for your individual travel needs.

Types of Travel Insurance

Several types of travel insurance policies cater to different needs and trip circumstances. Understanding these distinctions is crucial for selecting the right coverage.

Single Trip policies cover a specific trip with defined start and end dates. This is a popular option for vacations and short business trips.

Multi-Trip/Annual policies offer coverage for multiple trips taken within a year. This is often more cost-effective for frequent travelers.

Specialized travel insurance plans cater to particular activities or circumstances. Examples include adventure travel insurance for high-risk activities, student travel insurance, and cruise travel insurance.

Group travel insurance covers a group of people traveling together, often offering a discounted rate.

Importance of Medical Coverage

Medical coverage is arguably the most crucial aspect of travel insurance. Unexpected illnesses or injuries abroad can result in exorbitant medical bills, especially in countries with high healthcare costs. Without adequate coverage, travelers could face significant financial hardship.

Travel insurance with comprehensive medical coverage typically includes:

- Hospitalization: Covers costs associated with hospital stays, including room, board, and medical procedures.

- Emergency Medical Evacuation: Provides transportation to the nearest adequate medical facility or back home, if necessary.

- Repatriation of Remains: Covers the costs of returning a deceased traveler’s body to their home country.

Having this coverage provides peace of mind, knowing you are financially protected should a medical emergency arise during your travels. It allows you to focus on recovery rather than worrying about mounting medical expenses.

Coverage for Trip Cancellations

Trip cancellation coverage is a crucial component of travel insurance. It provides reimbursement for prepaid, non-refundable trip expenses if you have to cancel your trip for a covered reason.

These covered reasons are typically listed in your policy and often include unexpected events such as: serious illness or injury of you, a traveling companion, or a close family member; severe weather disrupting travel; and certain unforeseen circumstances like jury duty or mandatory evacuation at your destination.

It’s important to carefully review your policy’s specific list of covered reasons, as these can vary between providers. Be aware of what is not covered, such as cancellations due to a change of heart or fear of travel.

How to Choose the Right Plan

Selecting the right travel insurance plan requires careful consideration of your individual needs and trip specifics. Coverage limits are a crucial factor. Evaluate how much coverage you need for medical expenses, trip interruptions, and lost baggage. A higher coverage limit typically means a higher premium.

Your destination also plays a role. Some destinations may require specific coverage, such as for adventure activities or certain medical conditions. Consider the length of your trip, as longer trips necessitate longer coverage periods.

Finally, pre-existing conditions should be disclosed. Some plans may exclude coverage for these, while others may offer coverage with specific limitations or higher premiums. Review policy details carefully to ensure adequate protection for your circumstances.

Common Exclusions

While travel insurance offers valuable protection, it’s crucial to understand that not all situations are covered. Certain events and circumstances are commonly excluded from standard policies. Being aware of these exclusions can prevent unexpected expenses and disappointments during your travels.

Pre-existing medical conditions are often excluded unless a specific waiver is purchased. Be sure to disclose any pre-existing conditions when obtaining a policy. Activities considered high-risk, such as extreme sports or adventure activities, may also be excluded. Always check your policy wording carefully.

Travel to destinations under government travel advisories due to safety or security concerns is typically excluded. Additionally, claims arising from alcohol or drug-related incidents, or acts of war or terrorism, are generally not covered. Lost or stolen items due to negligence may also be excluded, so be mindful of your belongings.

Claim Process Explained

Filing a travel insurance claim can seem daunting, but understanding the process can alleviate stress during an unforeseen event. Generally, claims follow these key steps:

Step 1: Notification

Contact your insurance provider as soon as possible after an incident occurs. Timely reporting is crucial and often a requirement within your policy.

Step 2: Documentation

Gather all necessary documentation. This typically includes your policy details, trip itinerary, and supporting evidence related to the claim, such as medical bills, police reports, or receipts for lost items.

Step 3: Claim Form

Complete a claim form accurately and thoroughly. Provide all requested information and ensure supporting documentation is attached.

Step 4: Review and Processing

Your insurance provider will review your claim and supporting documentation. They may request additional information if needed. Once the review is complete, you will be notified of their decision.

Cost-Benefit Analysis

A key aspect of deciding on travel insurance involves weighing the costs against the potential benefits. Consider the premium of the policy relative to your total trip expenses. A cheaper policy may seem attractive, but may not provide adequate coverage for potential disruptions.

Think about the potential risks you face, such as medical emergencies, trip cancellations, or lost baggage. Evaluate the coverage amounts offered for these scenarios and how they align with your needs. For example, a traveler with pre-existing medical conditions might prioritize a policy with robust medical coverage.

Insurance for High-Risk Activities

Standard travel insurance policies often exclude coverage for high-risk activities. These activities can range from scuba diving and rock climbing to skydiving and bungee jumping.

If you plan on participating in such activities during your trip, you must secure a specialized policy or an add-on to your existing coverage that specifically addresses these risks. Failure to do so could leave you financially vulnerable in the event of an accident or injury.

Be sure to carefully review the policy wording to understand exactly what is and isn’t covered. Pay close attention to coverage limits, exclusions, and any specific requirements or conditions that may apply.

When to Buy Travel Insurance

The ideal time to purchase travel insurance is shortly after making your initial trip deposit or booking your flights and accommodations. This timing ensures you’re covered for unforeseen events that could force you to cancel your trip, such as illness or unexpected circumstances.

Buying early can also provide access to certain benefits like “cancel for any reason” coverage, which typically has a limited enrollment period. Delaying your purchase could limit your coverage options and leave you vulnerable to financial losses.

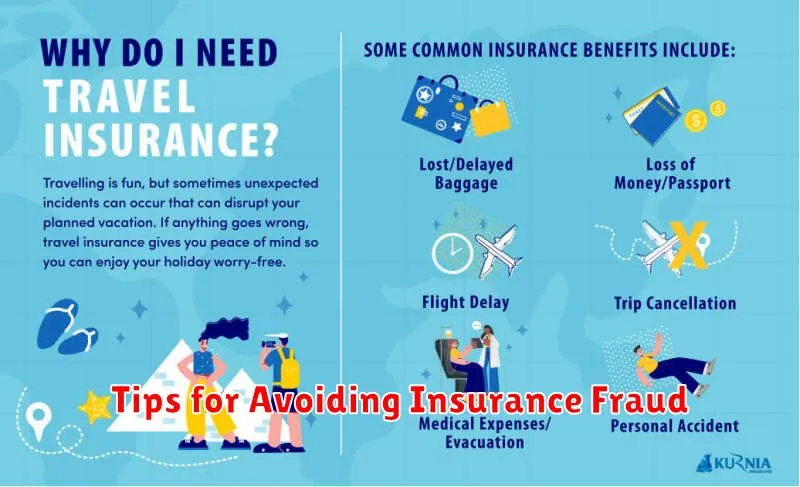

Tips for Avoiding Insurance Fraud

Be wary of unsolicited insurance offers. Legitimate insurers rarely contact individuals out of the blue. If you receive an unexpected call or email about travel insurance, exercise caution. Verify the company’s legitimacy independently through established regulatory bodies.

Thoroughly research insurance providers. Before purchasing any policy, confirm the company’s licensing and reputation. Check online reviews and consult with consumer protection agencies for any reported issues or complaints.

Understand your policy. Carefully review the terms and conditions of your travel insurance policy. Be aware of covered perils, exclusions, and claim procedures. Ask questions if anything is unclear.

Protect your personal information. Be cautious about sharing sensitive information like your social security number or credit card details unless you are certain of the recipient’s legitimacy. Secure websites utilize encryption to protect your data.