Planning an adventurous trip? Whether you’re scaling treacherous peaks, exploring uncharted territories, or diving into the deep blue, understanding the importance of comprehensive travel insurance is paramount. Travel insurance for adventurers offers specialized coverage beyond standard policies, protecting you from the unique risks associated with thrilling activities. This article will delve into the essentials of adventure travel insurance, outlining what you need to know to ensure you’re adequately protected on your next exhilarating journey.

From emergency medical evacuation in remote locations to coverage for lost or damaged gear, understanding the nuances of adventure travel insurance can be the difference between a thrilling memory and a financial catastrophe. We’ll explore the key aspects to consider when selecting a policy, such as activity coverage, trip cancellation options, and medical expense limits, empowering you to make informed decisions and embark on your adventures with confidence and peace of mind.

Coverage for Adventure Activities

Standard travel insurance policies often exclude or have limited coverage for high-risk activities. Adventurers participating in sports like mountaineering, scuba diving, or rock climbing need specialized coverage.

Look for policies specifically designed for adventure travel or add-ons to your standard policy that cover your chosen activities. Carefully examine the policy details to ensure your specific adventure activity is covered and understand any coverage limitations.

Consider the level of coverage required for potential risks such as medical emergencies, evacuation, and equipment loss or damage. Adequate coverage is crucial for peace of mind when participating in adventurous pursuits.

Understanding Policy Exclusions

Policy exclusions are specific situations or activities that your travel insurance will not cover. It’s crucial to understand these exclusions before purchasing a policy to avoid unexpected expenses. Ignoring them can lead to denied claims, leaving you financially responsible for losses incurred during your trip.

Common exclusions for adventure travelers often include participation in extreme sports such as base jumping or free solo climbing. Pre-existing medical conditions may also be excluded unless specifically declared and covered under a specific rider. Furthermore, traveling against government advisories might invalidate your policy.

Carefully review the policy wording for a comprehensive list of exclusions. Don’t hesitate to contact the insurance provider for clarification on anything you don’t understand. Understanding the exclusions is paramount to choosing the right travel insurance policy for your adventurous pursuits.

Comparing Adventure Travel Plans

Choosing the right adventure travel insurance requires careful comparison of different plans. Coverage is a key factor, encompassing medical emergencies, evacuation, and repatriation. Look for policies specifically designed for your chosen activities, such as mountaineering or scuba diving.

Policy limits are crucial. Ensure adequate coverage for potential medical expenses, especially in remote locations. Consider the deductible and premium costs. A higher deductible typically results in a lower premium, but you’ll pay more out-of-pocket in the event of a claim.

Finally, examine additional benefits. Some plans offer coverage for lost or stolen gear, trip interruption, or travel delays. Compare these extras to find a plan that best suits your needs and budget.

The Importance of Emergency Evacuation Coverage

For adventurers, travel insurance is more than just a precaution; it’s a necessity. Emergency evacuation coverage, in particular, is crucial. It can be the difference between a manageable medical incident and a financially and emotionally devastating ordeal.

Imagine experiencing a serious injury or illness in a remote location. Standard travel insurance may cover your hospital bills, but what about getting you to that hospital, especially if specialized care is required elsewhere? This is where emergency evacuation coverage becomes invaluable. It arranges and pays for medically necessary transportation, often involving air ambulances or other specialized vehicles, to the nearest appropriate medical facility.

The costs associated with these evacuations can be exorbitant, easily reaching tens of thousands of dollars. Without coverage, this financial burden falls squarely on you. Emergency evacuation coverage provides financial protection and peace of mind, ensuring you receive the necessary care without incurring crippling debt.

Checking the Fine Print

Before purchasing any travel insurance policy, thoroughly review the fine print. This is where the specific details of your coverage are outlined. Pay close attention to the definitions of key terms like “adventure activity,” “pre-existing condition,” and “baggage delay.” Misunderstandings about these terms can lead to denied claims.

Look for exclusions. Certain activities might be specifically excluded, such as extreme sports or off-piste skiing. Ensure the policy aligns with your planned itinerary. Examine the claim process. Understand the required documentation and timelines for filing a claim. Knowing this beforehand will simplify the process if an incident occurs.

Preparing Documentation for Claims

Proper documentation is crucial for a successful travel insurance claim. Organize your documents meticulously to expedite the process.

Start by gathering your insurance policy and any related amendments. Keep copies of your trip itinerary, including flight confirmations, accommodation details, and activity bookings. This establishes your intended travel plans.

If your claim involves a medical emergency, gather all medical reports, doctor’s notes, and hospital bills. For lost or stolen items, provide police reports and proof of ownership, such as receipts or photographs.

Finding Suitable Providers

Once you have a clear understanding of your needs, the next step is finding suitable insurance providers. Comparison websites are excellent resources for getting started. These platforms allow you to input your trip details and compare policies from multiple insurers side-by-side. Pay close attention to the coverage levels, exclusions, and the claims process of each policy.

Reading customer reviews can provide valuable insights into an insurer’s reputation and the efficiency of their claims handling. Don’t hesitate to contact providers directly to discuss your specific needs and ask any questions you may have. Ensuring you are comfortable with the provider and their policy is crucial before making a purchase.

Assessing Risk and Coverage Needs

Before choosing a travel insurance policy, carefully assess the potential risks associated with your adventure. Consider the destination, the activities you’ll be participating in, and your overall health.

High-risk activities like mountaineering or scuba diving often require specialized coverage. Think about potential medical emergencies, trip cancellations, lost baggage, and evacuation needs.

Evaluate your existing health insurance policy to understand its limitations abroad. Many standard policies don’t cover international medical expenses or emergency evacuations.

Common Mistakes to Avoid

When purchasing adventure travel insurance, avoid these common pitfalls. Failing to read the fine print is a critical oversight. Policies vary significantly, and assumptions can lead to denied claims. Another frequent mistake is underestimating activity risk levels. Accurately disclosing your planned activities ensures proper coverage.

Ignoring pre-existing condition clauses can also be problematic. Disclose any relevant medical history to avoid claim complications. Finally, waiting until the last minute to purchase coverage can limit options and leave you vulnerable.

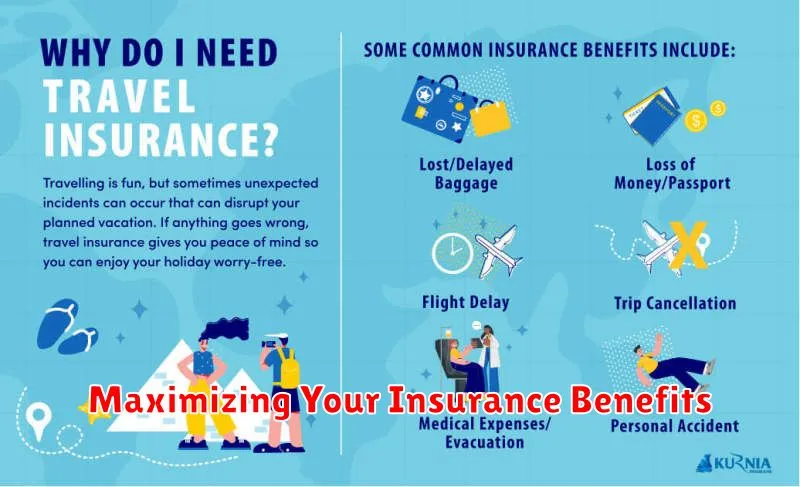

Maximizing Your Insurance Benefits

To ensure you receive the full benefits of your travel insurance, meticulous documentation is crucial. Keep records of all your travel documents, including your itinerary, flight confirmations, and accommodation bookings. Retain any receipts for expenses incurred due to covered events, such as medical bills or lost baggage expenses.

Report any incidents to your insurance provider as soon as possible. Timely reporting is often a requirement for successful claims. Follow the provider’s instructions carefully and provide all requested documentation promptly. Understanding your policy’s coverage limits and exclusions is also essential for maximizing your benefits. Review your policy carefully and contact your provider if you have any questions.